Let’s End Tax Break Giveaways for the Fat Cats of Pro Sports

CPA Practice

FEBRUARY 27, 2024

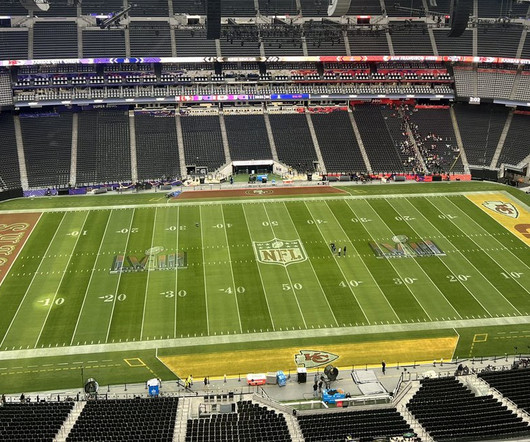

By Girard Miller, Governing (TNS) With Super Bowl LVIII fresh on our minds, it’s a good time to think twice about the local economics of professional sports. Local public officials are trapped in a no-win situation, which pits their residents’ love for local teams against the perverse economics of tax-privileged stadium financing.

Let's personalize your content